digital credit for farmers – tanzania

Opportunity: Airtel and Vodacom are two of the largest mobile money offerers in Africa, a field with over 120 million active acounts in 2021. Mobile money use is widespread, but digital credit – in the form of mobile money microloans – have yet to make headway. The Mastercard Foundation, alongside the Bill and Melinda Gates Foundation, both recognized the immense potential that a service like digital credit could offer to rural users, especially smallholder farmers, who must rely on unstable cash flows to maintain their businesses. In 2016, Dalberg Design partnered with Airtel and Vodacom in Tanzania to research and design a new digital credit system with features that specifically supported smallholder farmers.

Year: 2015

Role: Project co-lead

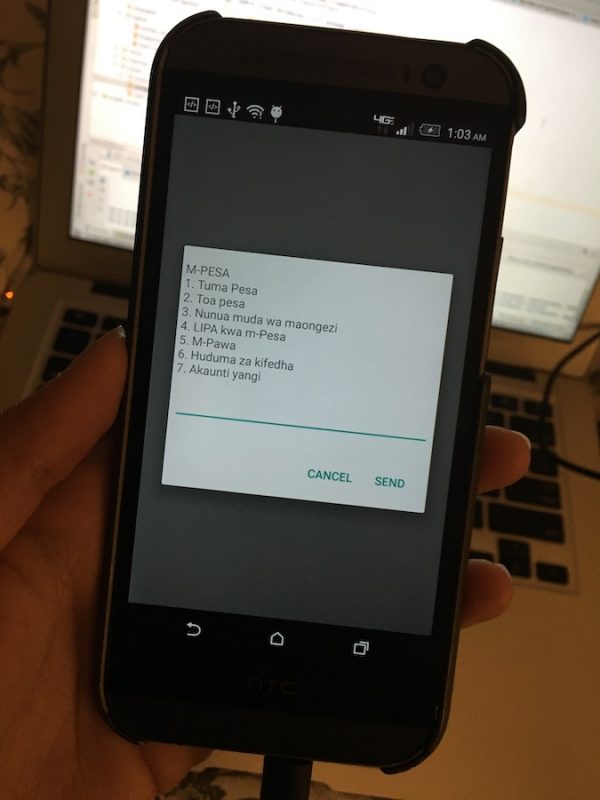

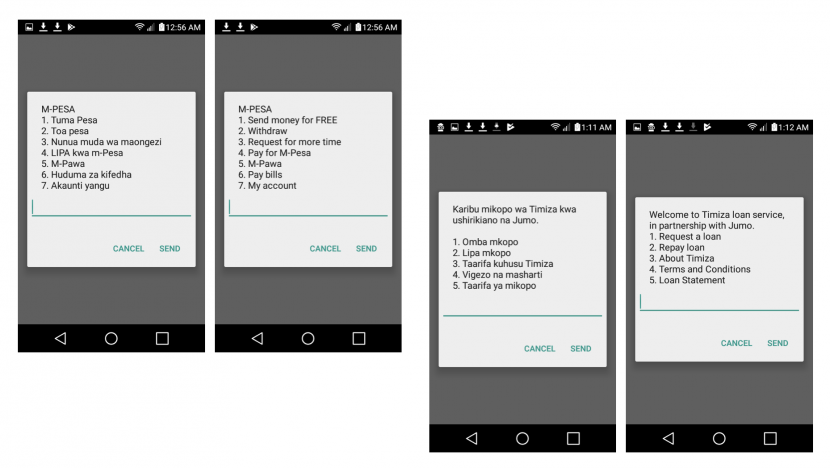

Process: Our team – a combined Dalberg Design and Dalberg Advisors team – spent several weeks researching in rural areas across Tanzania, speaking to smallholder farmers, farmer groups, and mobile money staff and operators to better understand the farming business cycle, related financial needs, and complications from existing sources of loans and money. We synthesized all our insights into ideas for how a digital credit system could work, along with a Android prototype of the accompanying USSD system that I developed. After going back to test our prototypes in another rural area of Tanzania, we finalized our designs and presented them to the Airtel and Vodacom teams in Dar es Salaam.

Outputs: Our team delievered a strategy report describing the financial and strategic case for a digital credit offering, alongside a complete set of screens and a working prototype of the envisioned USSD digital credit system. A brief describing the project was published on the Rural Finance and Investment Learning Center website as well.